|

|

|

|

|

|

1.

|

Review the information above.

Explain what you expect to learn from this lesson. Next, review the vocabulary words and look for

them as you work through this lesson

|

|

|

Just

as several factors can affect demand

at all price levels, a separate set of

factors can affect

supply. In this section,

you will read about these factors that can

affect supply, and the

factors that shift an

entire supply curve to the left or right.

| Input Costs

Any change in the cost of an input used to

produce a good—such as raw

materials,

machinery, or labor—will affect supply. A

rise in the cost of an input will

cause a fall

in supply at all price levels because the

good has become more expensive

to

produce. On the other hand, a fall in the

cost of an input will cause an increase

in

supply at all price levels. | | |

|

|

|

2.

|

Which statement is

true?

a. | A rise in the cost of an input will

cause a rise in supply while a fall in the cost of an input will cause an increase in

supply | c. | A rise in the cost of an input will

cause a fall in supply while a fall in the cost of an input will cause an increase in

supply | b. | A rise in the cost of an input will cause a fall in supply while a rise in the

cost of an input will cause an increase in supply | d. | A fall in the cost of an input will cause a fall in supply while a fall in the

cost of an input will cause a decrease in supply |

|

|

|

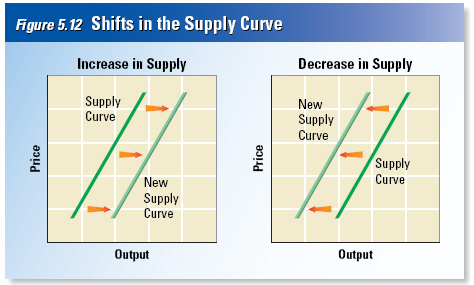

Factors that

reduce supply shift the supply curve to the left, while factors that increase supply move the supply

curve to the right.

Effect of Rising Costs

Think of the effects of input costs on the

relationship

between marginal revenue

(price) and marginal cost. A supplier sets

output at the most

profitable level, where

price is equal to marginal cost. Marginal

cost includes the cost of the

inputs that go

into production, so a rise in the cost of

labor or raw materials will translate

directly

into a higher marginal cost. If the cost of

inputs increases enough, the marginal

cost

may become higher than the price, and the

firm may not be as profitable as it could

be.

If a firm has no control over the price,

the only solution is to cut production

and

lower marginal cost until marginal cost

equals the lower price. Supply falls at

each

price, and the supply curve shifts to the left,

as illustrated in Figure

5.12. | Technology

Input costs can drop as well. Advances

in technology,

for example, can lower

production costs in many industries.

Sophisticated robots have replaced

many

workers on assembly lines and allowed

manufacturers to spend less on

salaries.

Computers have simplified tasks and cut

costs in fields as diverse as journalism

and

architecture. E-mail that can be sent and

received in an instant can replace

slowly

delivered letters and expensive long distance

phone calls.

Technology lowers

costs and increases

supply at all price levels. This effect is seen

in a rightward shift in the

supply curve in

Figure 5.12. | | |

|

|

|

3.

|

Things that reduce the supply

shift the curve to the

a. | right | c. | horizontal | b. | left | d. | vertical |

|

|

|

4.

|

Imagine that you are a

contractor who builds homes in the Chula Vista area. You have no control of the price of homes

because the market keeps changing. You find that selling price of new homes has fallen and it now

costs you more to build the houses than you can sell them for. The cost of raw materials has risen

while the selling price for houses has fallen. What is your only option?

a. | cut the price of the

homes | c. | Raise the price of the

homes | b. | Produce more homes until the cost of building the homes equals the cost of

building them | d. | Produce fewer homes until the cost

of building the homes equals the cost of building them.

|

|

|

|

5.

|

Factors that increase supply

shift the supply curve to the

a. | right | c. | vertical | b. | left | d. | horizontal |

|

|

|

6.

|

Which graph best represents the

effects of higher costs?

a. | the one on the

left | c. | neither - this is a trick

question | b. | the one on the right |

|

|

|

7.

|

Adopting technology can have a

dramatic effect on a company. How would a company likely feel the effects of technology

.

a. | technology is not likely to effect a

company’s production | c. | production costs will most likely decline | b. | production costs will rise

dramatically | d. | production costs will most likely

increase |

|

|

|

Government’s Influence on Supply

The government has the power to affect the

supplies of

many goods. By raising or

lowering the cost of producing goods, the

government can encourage or

discourage

an entrepreneur or an industry within the

country or abroad.

Subsidies

One method used by governments to affect

supply

is to give subsidies to the producers

of a good, particularly food. A subsidy is

a

government payment that supports a

business or market. The government often

pays a

producer a set subsidy for each unit

of a good produced.

Governments have several reasons

for

subsidizing producers. European countries

faced food shortages during and after

World

War II. Although imported food is

cheaper, European governments protect

farms so that some will

be available to

grow food in case imports are ever cut off.

The government of France also

subsidizes

small farms because French citizens want

to protect the lifestyle and character of

the

French countryside.

| Governments in developing countries

often subsidize

manufacturers to protect

young, growing industries from strong

foreign competition. In the

past, countries

such as Indonesia and Malaysia have subsidized a national car company as a source

of pride, even though imported cars were less expensive to build. In Western Europe, banks and

national airlines were allowed to suffer huge losses with the assurance that the government would

cover their debts. In many countries, governments have stopped providing industrial subsidies in the

interest of free trade and fair competition.

In the United States, the federal

government

subsidizes producers in many industries.

Farm subsidies are

particularly

controversial, however, especially when

farmers are paid to take land out of

cultivation

to keep prices high. In these cases,

more efficient farmers are penalized,

and

farmers use more herbicides and pesticides

on lands they do cultivate to compensate

for

production lost on the acres the government pays them not to plant. | | |

|

|

|

8.

|

How does the government effect

supply produced by companies?

a. | They use their power to change the

cost of production | c. | They issue laws

that dictate what the demand for products will be | b. | They issues laws that dictate what the supply of products

will be | d. | Government action has no effect on supply

whatsoever |

|

|

|

9.

|

The government wants to

encourage people to use solar power. They will pay part of the cost of having solar power installed

in your home. Is this a subsidy?

|

|

|

10.

|

Which government activities

below can be considered a subsidy? pick 3

|

|

|

Taxes

A government can reduce the supply of

some goods by placing an excise tax on them. An excise tax is a tax on the production or sale

of a good. An excise tax increases production costs by adding an extra cost for each unit sold.

Excise taxes are sometimes used to discourage the sale of goods that the government thinks

are harmful to the public good, like cigarettes, alcohol, and high-pollutant gasoline. Excise taxes

are built into the prices of these and other goods, so consumers may not realize that they are paying

them. Like any increase in cost, an excise tax causes the supply of a good to decrease at all price

levels. The supply curve shifts to the left.

| Regulation

Subsidies and excise taxes represent ways that government directly affects supply by

changing revenue or production costs. Government can also raise or lower supply through indirect

means. Government regulation often has the effect of raising costs. Regulation is government

intervention in a market that affects the price, quantity, or quality of a good.

For many

years, pollution from automobiles harmed the environment. Starting in 1970, the federal government

required car manufacturers to install technology to reduce pollution from auto exhaust. For

example, new cars had to use lead-free fuel because scientists linked health problems to lead

in gasoline. Regulations such as these increased the cost of manufacturing cars and reduced the

supply. The supply curve shifted to the left. | | |

|

|

|

11.

|

What effect do excise taxes

have on products?

a. | It reduces supply and makes the

supply curve shifts to the right | c. | In increases supply because the cost of products is now

higher | b. | It increases demand for products | d. | It reduces supply and makes the supply curve shift to the

left |

|

|

|

12.

|

What do we call

government intervention in a market

that affects the price, quantity, or quality of a good.

a. | score

keeping | c. | investment | b. | regulation | d. | privatization |

|

|

|

13.

|

When the government demanded

that cars have pollution controls, how did the supply curve shift?

a. | to the

right | c. | horizontal | b. | to the left | d. | vertical |

|

|

|

Supply in

the Global Economy

As

you read in earlier chapters, a large and

rising share of goods and services is

produced in one

country and imported by

another to be sold to consumers. The

supplies of imported goods are

affected by

changes in other countries. Here are some

examples of possible changes in the

supply

of products imported by the U.S.

• The U.S. imports carpets from India.

An

increase in the wages of Indian workers

would decrease the supply of carpets to

the U.S.

market, shifting the supply curve

to the left.

• The U.S. imports telephones from

Japan.

A new technology that decreases the cost

of producing telephones would increase

the

supply of telephones to the U.S.

market, shifting the supply curve to the

right.

• The

U.S. imports oil from Russia. A new

oil discovery in Russia would increase the

supply of oil to

the U.S. market and shift

the supply curve to the right.

| Import restrictions also affect the

supply

curves of restricted goods. The total supply

of a product equals the sum of imports

and

domestically produced products. An import

ban on sugar would eliminate foreign

sugar

suppliers from the market, shifting the

market supply curve to the left. At any

price,

a smaller quantity of sugar would be

supplied. If the government restricted

imports by

establishing an import quota,

the supply curve would shift to the left, but

the shift would be

smaller than it would be

for an absolute ban on sugar imports.

| | |

|

|

|

14.

|

What is the total supply of a

product.

a. | the total produced in side the

country plus the total imported | c. | the total produced domestically | b. | the total demand plus the total

supply | d. | the total imported from other

countries |

|

|

|

15.

|

Canada, the U.S. and Mexico

have a treaty called the North American Free Trade Agreement. (NAFTA) It allows for the free exchange

of goods across borders. The workers in Mexico make $3 to $4 dollars an hour while American workers

make about $15 an hour. How is NAFTA likely to effect the unemployment rate in the United

States?

a. | More

unemployed | c. | Unemployment about

the same | b. | Less unemployed | d. | There is no way to tell |

|

|

|

16.

|

The U.S. and Cuba produce large

quantities of sugar. At the present time the U.S. does not import any sugar from Cuba. It is called

an embargo on Cuban sugar. The U.S. has just begun to restore relations with Cuba. What will happen

to domestic (U.S.) sugar supplies if we start to import sugar from Cuba. First think how the supply

of sugar will affect price. Next consider the supply of domestic sugar in

response.

a. | domestic supply will

increase | c. | domestic supply

will stay about the same | b. | domestic supply will decrease | d. | there is no way to tell what domestic supply will be until it

happens |

|

|

|

Other

Influences on Supply

While government can have an important

influence on the supply

of goods, there are

also other important factors that influence

supply.

Future Expectations of Prices

If you were a soybean farmer,

and you

expected the price of soybeans to double

next month, what would you do with the

crop

that you just harvested? Would you

sell it right now, or hold on to it until

soybean prices

rise? Most farmers would

store their soybeans until the price rose,

cutting back supply in the

short term.

If a seller expects the price of a good to

rise in the future, the seller will

store the

goods now in order to sell more in the

future. On the other hand, if the price

of

the good is expected to drop in the near

future, sellers will earn more money by

placing

goods on the market immediately

before the price falls. Expectations of

higher prices will

reduce supply now and

increase supply later, and expectations of

lower prices will have the

opposite effect.

In Chicago there is a market, much like the stock exchange, where people buy

and sell commodities such as food to make money. The idea is to buy food at a low price, hold on to

it, and then sell when the price goes up. Of course if the price of the food falls you could

loose money.

The Chicago Commodities

Exchange | Inflation

Inflation is a condition of rising prices.

During periods of inflation,

the value of

cash in a person’s pocket decreases from

day to day as prices rise. Not too

long ago,

one dollar could buy a movie ticket or a

small meal, but inflation over many

years

has reduced the value of the dollar.

However, a good will continue to hold its

value,

provided that it can be stored for a

long period of time. When faced with inflation,

suppliers

prefer to hold on to goods

that will maintain their value rather than

sell them for cash that

loses its value

rapidly. As a result, inflation can affect

supply by encouraging suppliers to

hold on

to goods as long as possible. In the short

term, supply can fall

dramatically.

During the Civil War, the South faced

terrible inflation. The prices of most

goods

rose very quickly. There were shortages of

food, and shopkeepers knew that prices

on

basic food items like flour, butter, and

salt would rise each month. A few decided

to hoard

their food and wait for higher

prices. They succeeded too well; the supply

of food fell so much

that prices rose out

of the reach of many families. Riots broke

out in Virginia and elsewhere

when hungry

people decided they weren’t going to wait

for the food to be released from

the warehouses, and the shopkeepers lost their

goods and their

profits.

Number of Suppliers

One additional factor to consider

when

looking at changes in supply is the number

of suppliers in the market. If more

suppliers

enter a market to produce a certain good,

the market supply of the good will

rise,

and the supply curve will shift to the right.

On the other hand, if suppliers

stop

producing the good and leave the market,

the supply will decline. There is a

positive

relationship between the number of

suppliers in a market and the market

supply of

the good.

| | |

|

|

|

17.

|

You are a farmer who grows

corn. You believe that in 6 months the price of corn will rise dramatically. What would you do to

maximize your profits?

a. | Sell now

| c. | Do not sell at

all | b. | Hold on to your corn and sell in 6 months | d. | Sell now and charge more for your

corn. |

|

|

|

18.

|

Ethanol is made from corn. Cows

eat corn. The government requires all gasoline to contain a certain amount of ethanol. THINK!! How

will this effect the future price of meat?

a. | The price of beef will

rise | c. | The price of beef is not effected

because the government does not require cows to eat corn | b. | The price of beef will

fall | d. | The price of beef will remain the

same |

|

|

|

19.

|

Inflation is a measure

of

a. | how many goods and services are

controlled by government price supports | c. | how many goods and services a dollar will

buy | b. | how many people have full time jobs in the

economy | d. | how many goods and services are available for

purchase |

|

|

|

20.

|

In 1950 I quit school and went

to work full time. I made 75 cents an hour. Gasoline cost 25 cents a gallon so I could buy about 3

gallons of gas for an hours work. Today gasoline costs about $3.50 a gallon but a starting wage is

about $10. an hour. What effect has inflation had on the price of a gallon of

gasoline?

a. | Has had no effect at all. Gasoline

costs about the same today as it did in 1950 | c. | Inflation has made the price of gasoline go

higher | b. | The price of gasoline has risen dramatically | d. | Inflation has made the price of gasoline go

lower |

|

|

|

21.

|

Victor Santana owns a small

Mexicans restaurant in a small town. Everyone loves Victor’s Mexican food and he makes a good

living with his restaurant. Sensing the demand for Mexican food, Taco Bell opens a restaurant in the

small town. Then two other people open Mexican restaurants in the same town. What can we expect the

market supply of taco’s to be in this small town?

a. | the supply of taco’s will go

down | c. | `there should be no change in the

supply of taco’s | b. | the supply of taco’s will rise | d. | because of the competition everyone will eat more

taco’s |

|

|

|

Where Do

Firms Produce?

So far we

have ignored the issue of where

firms locate their production facilities. For

many firms, the

key factor is the cost of

transportation—the cost of transporting

inputs to a production

facility and the cost

of transporting the finished product to

consumers. A firm will locate

close to

input suppliers when inputs, such as raw

materials, are expensive to transport.

A

firm will locate close to its consumers when

output is more costly to transport.

For

an example of a firm that locates

close to its input suppliers, consider a firm

that cooks

tomatoes into tomato sauce.

Suppose that a firm uses seven tons of

tomatoes to produce one ton

of sauce. The

firm locates its plant close to the tomato

fields—and far from its

consumers—

because it is much cheaper to ship one ton

of sauce to consumers than to ship

seven

tons of tomatoes to the plant. Tomato

sauce producers cluster in places

like

California’s Central Valley where weather

and soil conditions are favorable for

the

growing of tomatoes.

| For an example of a firm that locates close

to its

consumers, consider a firm that bottles

soft drinks. The firm combines concentrated

syrup with

local water, so the firm? ’s

output (canned drinks) weighs more than its

transportable

input (syrup). As a result, the

firm locates close to its consumers—and far

from its

syrup supplier—because the firm

saves more on transporting soft drinks than

it pays to

transport its syrup. In general, if a

firm’s output is bulky or perishable, the firm

will

locate close to its consumers.

Other firms locate close to inputs that

cannot be

transported at all. Some firms

are pulled toward concentrations of

specialized workers such as

artists, engineers, and programmers. Other firms are pulled toward locations with low energy

costs. Many firms locate in cities because of the rich variety of workers and business services

available in urban areas. | | |

|

|

|

22.

|

Which statement below is

true

a. | Companies will try to locate their

factories in places that minimize transportation costs | c. | Transportation costs are the same all of the country so it does not

matter | b. | Companies have little concern over transportation

costs | d. | Transportation costs do not matter because they are tax

deductible |

|

|

|

a. | subsidy | c. | regulation | b. | excise tax |

|

|

|

23.

|

a tax on the production or sale of a good

|

|

|

24.

|

a government payment that

supports a business or market

|

|

|

25.

|

government intervention in a

market that affects the production of a good

|