|

|

|

|

|

|

1.

|

Examine the introduction to this section, above.

Explain what you expect to

learn in this section

|

|

|

How do borrowers raise money for

investment?

One of the most important

ways is by selling bonds. As you read in

Chapter 8, bonds are

certificates sold by a

company or government to finance projects

or expansion.

For

example, starting in 1942, the United

States Department of Treasury launched

bond drives to

encourage Americans to

buy “war bonds”—government savings

bonds that helped

finance World War II.

Movie stars and war heroes urged the

public to buy bonds. Even school

children

brought their dimes and quarters to school

each week, buying defense stamps

that

would eventually add up to the price of a

war bond.

During World War Two school

children bought “savings stamps,” which they pasted in a book. When the book was full it

could be traded for a War Bond. Mr Schneemann still has one of those books with a few stamps in

it. |

| | |

|

|

|

2.

|

What was the purpose of War Bonds.

a. | prevent inflation | c. | provide bank liquidity | b. | end the

depression | d. | finance the

war |

|

|

|

Bonds as Financial Assets

Bonds are basically

loans, or IOUs, that

represent debt that the government or a

corporation must repay to an

investor.

Bonds typically pay the investor a fixed

amount of interest at regular intervals for

a

fixed amount of time. Bonds are generally

lower-risk investments. As you might

expect from

your reading about the relationship between risk and return, the rate

of return on bonds is

usually also lower

than for other investments.

The Three

Components of Bonds

Bonds have three basic components:

• Coupon rate

The coupon rate is the

interest rate that the bond issuer will pay

to the

bondholder.

• Maturity is the time at which

payment to the bondholder

is due.

Different bonds have different lengths of

maturity. Bonds typically mature in

10,

20, or 30 years.

• Par value A bond’s par value is

the

amount that an investor pays to purchase

the bond and that will be repaid to

the

investor at maturity. Par value is also

called face value or

principal.

| Suppose that you buy a $1,000

bond

from the corporation Jeans, Etc. The

investor who buys the bond is called

the

“holder.” The seller of a bond is the

“issuer.” You are therefore

the holder of

the bond, and Jeans, Etc. is the issuer. The

components of this bond are as

follows:

• Coupon rate: 5 percent, paid to the

bondholder annually

•

Maturity: 10 years

• Par Value: $1,000

How much money will you earn

from

this bond, and over what period of time?

The coupon rate is 5 percent of $1,000

per

year. This means that you will receive a

payment of $50 (.05 times $1,000) each

year for

ten years, or a total of $500 in

interest. In ten years, the bond will have

reached maturity,

and Jeans, Etc. will retire

the debt. This means that the company’s

debt to you will have

ended, and that Jeans,

Etc. will pay you the par value of the bond,

or $1,000. Thus, for your

$1,000 investment,

you will have received $1,500 over a

period of ten years.

Not all

bonds are held to maturity. Over

their lifetime they might be bought or

sold, and their price

may change. Because

of these shifts in price, buyers and sellers

are interested in a

bond’s yield, or yield to

maturity. Yield is the annual rate of return

on the bond

if the bond were held to

maturity (5 percent in the example above

involving Jeans,

Etc.). | | |

|

|

|

3.

|

What are bonds?

a. | Loans made mostly to individuals | c. | Loans made to corporations

only | b. | Loans made to governments only | d. | Loans made to corporations and

governments |

|

|

|

4.

|

The city of Chula Vista is selling bonds to build a new library. What is the

discount rate?

a. | The amount of money that Chula Vista will save by selling bonds | c. | The amount of

interest the bond holder must pay to Chula Vista | b. | The savings (discount) Chula Vista will receive

on building supplies | d. | The

amount of interest Chula Vista must pay to the bond holder |

|

|

|

5.

|

You own a bond that you purchased to help the city of Chula Vista build a new

library. What is the face value of the bond called?

a. | the discount rate | c. | the sub-prime rate | b. | the par value | d. | the yield |

|

|

|

6.

|

When will the city of Chula Vista be required to repay the money you gave them

by purchasing a bond?

a. | the maturity date of the bond | c. | they will never be required to

repay the bond | b. | immediately after the bond was purchased | d. | when the library

opens |

|

|

|

7.

|

In our library bond scenario, the city of Chula Vista is called the _____ and

you are called the _____ .

a. | holder - issuer | c. | bank - bond holder | b. | issuer - holder | d. | bond holder -

bank |

|

|

|

8.

|

The bond you purchased from the city of Chula Vista has a par value of $1000, a

coupon rate of 7% and a maturity date of 10 years. At the end of 10 years you cash in your bond. How

much money will you receive?

a. | $1,000 | c. | $1,700 | b. | $ 1,500 | d. | $ 700. |

|

|

|

9.

|

Your library bond does not have to be held to maturity.If you sell it after 5

years, how much would your receive?

a. | $ 1,350 | c. | $ 1,700 | b. | $ 1,500 | d. | $ 1,000 |

|

|

|

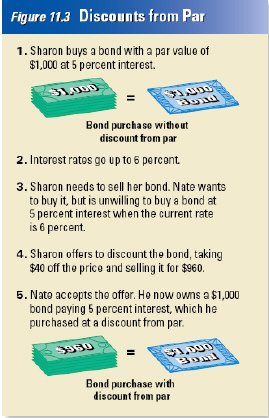

Buying Bonds at a Discount

Investors earn

money from interest on the

bonds they buy. They can also earn money

by buying bonds at a

discount, called a

discount from par. In other words, if Nate

were buying a bond with a par

value of

$1,000, he may be able to pay only $960

for it. When the bond matures, Nate

will

redeem the bond at par, or $1,000. He will

thus have earned $40 on his investment,

in

addition to interest payments from the

bond issuer.

Why would someone sell a bond for

less

than its par value? The answer lies in the

fact that interest rates are always

changing.

For example, suppose that Sharon buys a

$1,000 bond at 5 percent interest, which

is

the current market rate. A year later, she

needs to sell the bond to help pay for a

new

car. By that time, however, interest rates

have risen to 6 percent. No one will

pay

$1,000 for Sharon’s bond at 5 percent

interest when they could go elsewhere

and

buy a $1,000 bond at 6 percent interest.

For Sharon to sell her bond at 5 percent,

she

will have to sell it at a discount. (See

Figure 11.3.) |

Investors can earn money by buying bonds

at a discount, called a discount from par.

Interest Rates

How do interest rates affect bond prices? | | |

|

|

|

10.

|

If you purchase your Chula Vista library bond at a discount rate, what will you

pay for the bond?

a. | more than the par value | c. | less than the maturity

rate | b. | less than the par value | d. | more than the interest rate |

|

|

|

11.

|

Why would Chula Vista want to sell its bonds at a discount?

a. | To make more money available for the library | c. | Interest rates change so its bonds

would be less desirable | b. | To lower the investment

rate | d. | Interest rates change

so its bonds would be more desirable |

|

|

|

Bond Ratings

How does an investor decide which

bonds

to buy? Investors can check bond quality

through two firms that publish bond

ratings.

Standard & Poor’s and Moody’s

rate bonds on a number of factors,

including the

issuer’s ability to make future

interest payments and to repay the principal

when the

bond matures. These

companies rating systems rank bonds

from the highest investment grade (AAA

in

the Standard & Poor’s system or Aaa in

the Moody’s rating system) to the

lowest

(D in both systems). A bond rating of D

generally means that the bond is

in

default—that is, the issuer has not kept up

with interest payments or has defaulted

on

paying principal.

The higher the bond rating, the lower the

interest rate the company

usually has to

pay to get people to buy its bonds. For

example, a AAA bond may be issued at

a

5 percent interest rate. A BBB bond,

however, may be issued at a 7.5 percent

interest

rate. The buyer of the AAA bond

trades off a lower interest rate for lower

risk. The buyer of

the BBB bond trades

greater risk for a higher interest rate.

|

Similarly, the higher the bond rating, the

higher the price at which the bond will

sell.

For example, a $1,000 bond with an AAA (or “triple A”) rating may sell at

$1,100. A

$1,000 bond with a BBB rating may sell for

only $950 because of the increased

risk

that the seller could default.

In essence, holders of bonds with high

ratings who

keep their bonds until

maturity face relatively little risk of losing

their investment. Holders

of bonds with

lower ratings, however, take on more risk

in return for potentially higher

interest

payments. | | |

|

|

|

12.

|

What does Standard & Poor’s and Moody’s do?

a. | They rank bonds based on the risk to sellers | c. | They make funds available to

investors | b. | They rank bonds based on the risk to investors | d. | They make funds available to

sellers |

|

|

|

13.

|

A few years ago Moody’s lowered the bond ranking of the United States. Why

would they do that?

a. | They believed that the value of the dollar was too low | c. | They believed that the United

States was not conducting its financial affairs in a responsible manner | b. | They believed that

the United States was not providing enough goods and services to its citizens | d. | They believed that the value of the dollar was

too high |

|

|

|

14.

|

Which statement is true?

a. | The lower the rating the higher the risk | c. | The higher the risk the higher the

rating | b. | The lower the rating the lower the risk | d. | The higher the rating the higher the

risk |

|

|

|

Advantages and Disadvantages

to the

Issuer

From the point of view of the investor,

bonds are good investments because

they

are relatively safe. Bonds are desirable

from the issuer’s point of view as well,

for

two main reasons:

1. Once the bond is sold, the coupon rate

for that bond

will not go up or down.

For example, when Jeans, Etc. sells

bonds, it knows in advance that it

will be

making fixed payments for a specific

length of time.

2. Unlike

stockholders, bondholders do not

own a part of the company. Therefore,

the company does not

have to share

profits with its bondholders if the

company does particularly well.

| On the other hand, bonds also pose two

main disadvantages to

the issuer:

1. The company must make fixed interest

payments, even in bad years when

it does

not make money. In addition, it cannot

change its interest payments even

when

interest rates have gone down.

2. If the firm does not maintain

financial

health, its bonds may be downgraded to

a lower bond rating and thus may be

harder

to sell unless they are offered at a

discount.

| | |

|

|

|

15.

|

What are two advantages to the seller of bonds? (pick 2)

|

|

|

Types of Bonds

Despite these risks to the

issuer, when

corporations or governments need to

borrow funds for long periods, they

often

issue bonds. There are several different

types of bonds.

Savings Bonds

You may already be familiar with savings

bonds,

which are sometimes given to young

people as gifts. Savings bonds are low denomination ($50

to $10,000) bonds

issued by the United States government.

The government uses funds from the

sale

of savings bonds to help pay for public

works projects like buildings, roads, and

dams.

Like other government bonds,

savings bonds have virtually no risk of

default, or failure to

repay the loan.

The federal government pays interest

on savings bonds. However, unlike

most

other bond issuers, it does not send interest

payments to bondholders on a

regular

schedule. Instead, the purchaser buys a

savings bond for less than par value.

For

example, you can purchase a $50 savings

bond for only $25. When the bond

matures, you

receive the $25 you paid for

the bond plus $25 in interest.

| Treasury Bonds, Bills, and Notes

The United

States Treasury Department

issues Treasury bonds, as well as Treasury

bills and notes (T-bills

and T-notes). These

investments offer different lengths of

maturity, as shown in Figure 11.6.

Backed

by the “full faith and credit” of the United

States government, these

securities are

among the safest investments in terms of

default risk. The federal

government

temporarily stopped selling 30-year bonds

in 2001, upsetting many investors who

like

safe, long-term investments. | | |

|

|

|

16.

|

What is one advantage to purchasing government bonds?

a. | The interest rate changes in response to changes in the inflation rate | c. | There is almost no

chance that the bond purchaser will loose their investment because the seller goes

broke | b. | Government bonds usually pay a higher rate of interest than other types of

bonds. | d. | Government bonds are

protected by the Second Amendment to the U.S. Constitution |

|

|

|

17.

|

Which statement is true about Savings Bonds?

a. | Savings bonds are sold for less than par value and pay interest only after the bond

matures | c. | Savings bonds are sold for par value and pay interest to the bond holder on a regular

monthly basis. | b. | Savings bonds are sold for par value | d. | Savings bonds have no par value but they do pay

an interest rate |

|

|

|

18.

|

Which entity backs TBills and TNotes with its full faith and credit

a. | State Banks | c. | the United Nations | b. | Federal Credit Unions | d. | the U.S.

Government |

|

|

|

Types of Bonds

Municipal Bonds

State and local governments and

municipalities (government units with corporate

status) issue bonds to finance

such

improvements as highways, state buildings,

libraries, parks, and schools. These

bonds

are called municipal bonds, or “munis.”

Because state and local

governments have

the power to tax, investors can assume that

these governments will be able to

keep up

with interest payments and repay the principal

at maturity. Standard & Poor’s

and

Moody’s therefore consider most municipal

bonds to be safe investments,

depending

upon the financial health of a particular

state or town. In addition, the interest

paid

on municipal bonds is not subject to income

taxes at the federal level or in the

issuing

state. Because they are relatively safe and

are tax-exempt, “munis” are

very attractive

to investors.

|

Corporate Bonds

As you read in Chapter 8,

corporations

issue bonds to help raise money to expand

their businesses. These corporate

bonds are issued in fairly large denominations, such

as $1,000, $5,000, and $10,000.

The

interest on corporate bonds is taxed as

ordinary income.

Unlike city and other

governments, corporations have no tax base to help guarantee their ability to repay their loans, so

these bonds have moderate levels of risk. Investors in corporate bonds must depend on the success of

the corporation’s sales of goods and services to generate enough income to pay interest and

principal.

Corporations that issue bonds are

watched closely not only by Standard

&

Poor’s and Moody’s, but also by the

Securities and Exchange Commission

(SEC). The SEC is an independent government agency that regulates financial markets and

investment companies. It enforces laws prohibiting fraud and other dishonest investment

practices. | | |

|

|

|

19.

|

The City of Chula Vista wants to develop the bay front. What types of bonds are

they likely to sell to raise the needed money?

a. | Corporate Bonds | c. | Municipal Bonds | b. | Water Bonds | d. | Savings Bonds |

|

|

|

20.

|

What is true about Muni’s?

a. | They are safer than most other types of bonds | c. | They pay a higher rate of interest

than most other types of bonds | b. | They are less safe than most other types of

bonds | d. | Buying Muni’s

gives the buyer part ownership in the corporation |

|

|

|

21.

|

The purchaser of Municipal Bonds does not have to pay federal taxes on

the interest earned

|

|

|

22.

|

Why are corporate bonds more risky than municipal bonds?

a. | corporate bonds depend on taxes to secure their bonds | c. | municipal bonds must depend on the

sale of goods and services | b. | corporate bonds must depend on the success of

the corporation to sell goods and services | d. | municipal bonds and corporate bonds share the same risk to bond

holders |

|

|

|

23.

|

What does the Securities and Exchange Commission (SEC) do?

a. | sets the corporate bond rates | c. | sets the municipal bond

rates | b. | holds the investments of bond purchasers | d. | regulates financial markets and investment

companies |

|

|

|

Types of Bonds

Junk Bonds

Junk bonds, or high-yield securities,

are

lower-rated, and potentially higher-paying,

bonds. They became especially

popular

investments during the 1980s and 1990s, when large numbers of aggressive

investors

made—but also sometimes lost—large

sums of money buying and selling

these

securities.

Junk bonds have been known to pay

over 12 percent interest at a time

when

government bonds are yielding only about

8 percent interest. On the other hand,

junk

bonds also carry bond ratings of“lower

medium grade” or

“speculative” (BB, Ba,

or lower). Investors in junk bonds therefore

face a strong

possibility that some of the

issuing firms will default on their debt. |

Nevertheless, in many cases junk bonds

have enabled companies to undertake

activities that would otherwise have been impossible to complete. (For more information on how to

follow the progress of a stock by

reading stock market reports, see page 284.) | | |

|

|

|

24.

|

What is true about “junk bonds?”

a. | they pay higher interest rates but are more risky as investments | c. | they are safer than

municipal bonds

| b. | they pay higher interest rates and are more

safe than other investments | d. | they have a higher bond rating than corporate bonds |

|

|

|

|

|

|

25.

|

Standard & Poor’s and Moody’s rate bonds according to their

assessments of the issuer’s ability to make interest payments and to repay the principal when

the bond matures.

What bond rating carries the least risk?

|

|

|

|

|

|

26.

|

Treasury bonds, notes, and bills represent debt that the government must repay

the investor. Which has the longest maturity time?

a. | Treasury Bills | c. | Treasury Notes | b. | Treasury Bonds |

|

|

|

27.

|

Which type allows you to get your money out the easiest?

a. | Treasury Bills | c. | Treasury Note | b. | Treasury Bonds |

|

|

|

Other Types

of Financial Assets

In addition

to bonds, investors may choose

other financial assets. These include certificates of deposit and

money market mutual funds, as well as stock. You will read more about stock in Section 3.

Certificates of Deposit

Certificates of deposit (CDs) are one

of the

most common forms of investment. As you

read in Chapter 10, CDs are available

through

banks, which lend out the funds

deposited in CDs for a fixed amount of

time, such as 6 months

or a year. CDs are attractive to small investors because they cost as little as $100. Investors can

also choose among many terms of maturity. This means that if an investor foresees a future

expenditure, such as college tuition or a major home improvement, he or she can buy a CD that matures

just before the expenditure is due.

|

Money Market Mutual

Funds

Money market mutual funds are special

types of mutual funds. As you read

in

Section 1, businesses collect money from

individual investors and then buy stocks,

bonds,

or other financial assets to form a

mutual fund.

In the case of money market

mutual

funds, intermediaries buy short-term financial

assets. Investors receive higher

interest

on a money market mutual fund than they

would receive from a savings account.

On

the other hand, money market mutual

funds are not covered by FDIC insurance.

(As you read

in Chapter 10, FDIC insurance

protects bank deposits up to $100,000

per account). This makes

them slightly

riskier than savings accounts. | | |

|

|

|

28.

|

Why are Certificates of Deposits (CD’s) popular among small

investors?

a. | They are inexpensive and it is easy to get your money out when you need

it | c. | They are expensive but it is easy to get your money out when you need

it | b. | They are inexpensive and they are long term forcing the investor to

save | d. | It is hard to get your

money out but they are inexpensive |

|

|

|

29.

|

Which statement is true about Money Market Mutual Funds?

a. | Mutual Funds are not popular with investors | c. | Mutual Funds are prohibited by the

U.S. Government and are classified as Junk Bonds | b. | Mutual Funds pay a lower rate of interest than

savings accounts but are covered by FDIC and are therefore less risky | d. | Mutual Funds pay a higher rate of interest than

savings accounts but are not covered by FDIC and are therefore more

risky |

|

|

|

Financial Asset Markets

Financial assets,

including bonds, certificates

of deposit, and money market mutual

funds, are traded on

financial asset markets.

The various types of financial asset markets

are classified in

different ways.

Capital and Money Markets

One way

to classify financial asset markets

is according to the length of time for which

funds are

lent. This type of classification

includes capital markets and money

markets.

• Capital Markets in which

money is lent for periods longer than a

year are called

capital markets. Financial

assets that are traded in capital markets

include long-term

CDs and corporate

and government bonds that require more

than a year to mature.

• Money Markets in which

money is lent for periods of less than a

year are called

money markets. Financial

assets that are traded in money markets

include short-term CDs,

Treasury bills,

and money market mutual funds.

| Primary and Secondary Markets

Markets may also

be classified according to

whether assets can be resold to other

buyers. This type of

classification includes

primary and secondary markets.

• Primary markets

Financial assets that

can be redeemed only by the original

holder are sold on primary

markets.

Examples include savings bonds, which

are non-transferable (that is, the

original

buyer cannot sell them to another

buyer). Small certificates of deposit are

also in

the primary market because

investors would most likely cash them in

early rather than try to

sell them to

someone else.

• Secondary markets Financial assets that

can

be resold are sold on secondary

markets. This option for resale provides

liquidity to

investors. If there is a strong

secondary market for an asset, the

investor knows that the

asset can be

resold fairly quickly without a penalty,

thus providing the investor with

ready

cash. The secondary market also makes

possible the lively trade in stock that is

the

subject of the next section. | | |

|

|

|

30.

|

Which financial asset market has the shortest maturity time?

a. | capital markets | c. | primary markets | b. | money markets | d. | secondary

markets |

|

|

|

31.

|

Which financial asset markets include long-term CDs and corporate and government

bonds

a. | capital markets | c. | primary markets | b. | money markets | d. | secondary

markets |

|

|

|

32.

|

What is the difference between primary and secondary markets?

a. | who controls at least 51% of the corporations issuing the bonds | c. | the amount of taxes

paid on interest earned | b. | who can redeem the financial

assets | d. | whether or not they

are covered by FDIC |

|

|

|

a. | municipal bond | h. | savings bond | b. | par value | i. | coupon rate | c. | junk

bond | j. | primary

market | d. | maturity | k. | capital market | e. | secondary market | l. | corporate bond | f. | Securities and

Exchange Commission | m. | money

market | g. | yield |

|

|

|

33.

|

a bond that a corporation issues to raise money to expand its

business

|

|

|

34.

|

an independent agency of the government that regulates financial markets and

investment companies

|

|

|

35.

|

the interest rate that a bond issuer will pay to a bondholder

|

|

|

36.

|

a lower rated, potentially higher-paying bond

|

|

|

37.

|

the amount that an investor pays to purchase a bond and that will be

repaid to the investor at maturity

|

|

|

38.

|

market for reselling financial assets

|

|

|

39.

|

the time at which payment to a bondholder is due

|

|

|

40.

|

market for selling financial assets that can only be redeemed by the

original holder

|

|

|

41.

|

the annual rate of return on a bond if the bond were held to

maturity

|

|

|

42.

|

market in which money is lent for periods of less than a year

|

|

|

43.

|

a bond issued by a state or local government or municipality to finance

such improvements as highways, state buildings, libraries, parks, and schools

|

|

|

44.

|

market in which money is lent for periods longer than a year

|

|

|

45.

|

low-denomination bond issued by the United States government

|