|

|

|

|

|

|

1.

|

Study the introduction above.

Look at the objectives. Explain what you are expected to learn from this section.

Study the

vocabulary words. Look for these words as you study this section. You will be tested on the words

later.

Good luck!

|

|

|

Do

you have a checking account, credit

card, or ATM card If you don ’t, you

most

likely will in the near future. As this

question suggests, people in the United

States today

use more than just paper

currency and coins to pay for purchases.

Measuring the Money Supply

You are familiar with paying for the

items

you need with currency —the bills and

coins in your pocket. Money consists

of

currency. It also consists of traveler’s

checks, checking account deposits, and

a

variety of other components. All of these

components make up the United States

money

supply —all the money available in

the United States economy. To more

easily

keep track of these different kinds of

money, economists divide the money

supply into

several categories. The main

categories are called M1 and M2.

M1

M1 represents money that people can gain

access to easily

and immediately to pay for

goods and services. In other words, M1

consists of assets that have

liquidity, or the

ability to be used as, or directly converted

into, cash.

As you can

see from Figure 10.5, about

48 percent of M1 is made up of currency held by the public, that is,

all currency held

outside of bank vaults. Another large part

of M1 is deposits in checking

accounts.

Funds in checking accounts are also called

demand deposits because checks can

be

paid “on demand, ” that is, at any

time.

| Until the 1980s, checking accounts did not

pay interest, and a new

category, called

other checkable

deposits, was introduced

to describe checking accounts that did pay

interest. Today this

distinction is not as

meaningful as it once was since many

checking accounts pay interest if

your

balance is sufficiently high.

Traveler’s checks make up a very small

component of

M1. Unlike personal checks,

traveler’s checks can be easily turned into

cash.

M2

M2 consists of all the assets in M1 plus

several

additional assets. These additional

M2 funds cannot be used as cash directly,

but can be

converted to cash fairly easily.

M2 assets are also called near money.

For example,

deposits in savings

accounts are included in M2. They are not

included in M1 because they

cannot be

used directly in financial exchanges. You

cannot hand a sales clerk your

savings

account passbook to pay for a new

backpack. You can, however, withdraw money from your

savings account and then

use that money to buy a backpack.

Deposits in money market

mutual funds are

also included as part of M2. These are

funds that pool money from small

savers

to purchase short-term government and

corporate securities. They earn interest

and

can be used to cover checks written over a

certain minimum amount, such as $250.

You

will read more about money market

mutual funds in Chapter 11. | | |

|

|

|

2.

|

What is

M1?

a. | money that get easily to pay for

goods and services such as cash | c. | security bonds | b. | money kept in the vaults at Ford Knox | d. | Money 1 dollar bills |

|

|

|

3.

|

Why do economists use

categories such as M1 and M2 with regards to the money supply?

a. | to expand the money

supply | c. | to decrease the money

supply | b. | keep track of the different kinds of money | d. | make money distribution easier |

|

|

|

4.

|

What is

liquidity?

a. | gold and silver bars which are

melted at a foundry | c. | liquid money such

as oil and gas | b. | money kept in a safe place such as Swiss

banks | d. | money that is readily available for

spending |

|

|

|

5.

|

When you pay your bills with

demand deposits, what are you doing?

a. | using

cash | c. | obeying the demands of your

spouse | b. | making cash deposits into your bill holders bank

account | d. | writing

checks |

|

|

|

6.

|

What is another name for M2

assets?

a. | near

money | c. | Modern

Money | b. | funny money | d. | Movable deposits |

|

|

|

7.

|

When you purchase short term

money market securities, what kind of money are you getting.

a. | M1

money | c. | government long term

bonds | b. | M2 money | d. | government long term securities |

|

|

|

|

|

|

8.

|

The components of M1 can be

used as cash or can be easily converted into cash. M2

consists of the assets in M1 plus assets

that can be converted to cash fairly easily.

What is the largest component of M1?

a. | Currency | c. | Other checkable deposits | b. | Demand Deposits | d. | Travelers checks |

|

|

|

9.

|

The components of M1 can be

used as cash or can be easily converted into cash. M2

consists of the assets in M1 plus assets

that can be converted to cash fairly easily.

What is the largest component of M2?

a. | savings

deposits | c. | small denomination

time deposits | b. | Retail money market funds | d. | M1 |

|

|

|

10.

|

You are going to the prom.

Before the dance you are going to take your date out to dinner. Which type of currency should you

have on hand?

a. | near

money | c. | M1 | b. | savings deposits | d. | M2 |

|

|

|

|

|

|

11.

|

In a fractional reserve system,

banks keep only a fraction of funds on hand and lend out the rest. The funds lent out fuel the

economy and ensure continued growth. Why does the bank retain a percentage of the money it receives

from depositors?

a. | so they can be sure to make at least

20% profit | c. | to prevent 20% of

their depositors from withdrawing their money | b. | to have enough money on-hand in case depositors want to

withdraw all or part of their money | d. | there is no reason |

|

|

|

12.

|

What does the chart above

show?

a. | The safety of money deposits in the

banking system | c. | The flow of money

through the banking system and how it makes loan money available | b. | The greed of bankers | d. | The danger of lending money while keeping only 20% in

deposits |

|

|

|

| Simple and Compound

Interest

As you have

read, interest is the price paid for the use of borrowed money. The

amount borrowed is

called the principal.

Simple interest is interest paid only on

principal. For example,

if you deposit

$100 in a savings account at 5 percent

simple interest, you will make $5 in a

year (assuming that interest is paid annually).

Suppose that you leave the $5 in

interest

in the bank, so that at the end of the year

you have $105 in your account

—$100 in

principal and $5 in interest. Compound

interest is interest paid on both

principal

and accumulated interest. That means that in the second year, as long as you leave both

the principal and the interest in your account, interest will be paid on $105

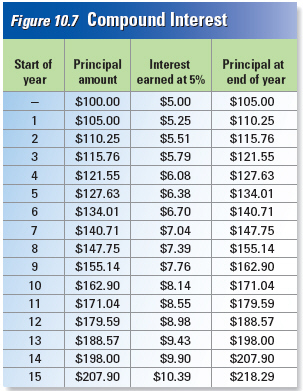

Figure 10.7 shows

how an account paying compound interest grows over time. | | |

|

|

|

13.

|

This chart shows the money

earned on a $100 deposit when interest is compounded yearly at

5 percent. How many years does it take for the original deposit to

double?

|

|

|

14.

|

You deposited $100 in the bank.

At 5% interest, how much have you earned at the end of 15 years?

a. | $218. | c. | $207 | b. | $118. | d. | $10.39 |

|

|

|

Functions

of Financial Institutions

Banks and other financial institutions are

essential to managing the money

supply.

They also perform many functions and

offer a wide range of services to

consumers.

Storing Money

Banks provide a

safe, convenient place for

people to store money. Banks keep cash in

fireproof vaults and are

insured against the

loss of money in the event of a robbery. As

you read in Section 2, FDIC

insurance

protects people from losing their money if

the bank is unable to repay funds.

Saving Money

Banks offer a variety of ways

for people to

save money. Four of the most common

ways are the following:

•

Savings accounts

• Checking accounts

• Money market

accounts

• Certificates of deposit (CDs)

|

Savings accounts and checking

accounts

are the most common types of bank accounts. They are especially useful for people who

need to make frequent withdrawals. Savings accounts and most checking accounts pay a small amount of

interest at an annual rate. Money market accounts and certificates of deposits (CDs) are special

kinds of savings accounts that pay a higher rate of interest than do savings and checking accounts.

Money market accounts allow you to save and to write a limited number of checks. Interest rates are

not fixed, but can move up or down. CDs, on the other hand, offer a guaranteed rate of interest over

a certain period of time. Funds placed in a CD, however, cannot be removed until the end of a certain

time period, such as one or two years. Customers who remove their money before that time pay a

penalty for early withdrawal.

| | |

|

|

|

15.

|

Which statement is

true?

a. | The government can manage the money

supply without banks and other financial instructions | c. | We do not need banks and other financial institutions to manage the money

supply | b. | The stock exchange can easily manage the money supply without interference

from banks and other financial institutions | d. | Banks and other financial institutions are needed to manage the money

supply |

|

|

|

16.

|

Which statement is

true?

a. | Banks are an unsafe place to store

money because they are frequently robbed. | c. | Banks are a safe place to store money because they convert cash into bonds

before they close each day | b. | Banks are an unsafe place to store money because they sometimes

fail | d. | Banks are a safe place to store money because of the

FDIC |

|

|

|

17.

|

Which statement is

true?

a. | With Money Market Accounts you can

write a specific number of checks and interest rates never change | c. | With Money Market Accounts you can write an

unlimited number of checks and interest rates may go up or

down | b. | With Money Market Accounts you can write a specific number of checks and

interest rates may go up or down | d. | With Money Market Accounts you cannot write a checks but interest rates

always go up |

|

|

|

18.

|

If you invest your money in

CDs, you can be sure that

a. | your interest rate will never change

and you will be able to take out your money at any time without a

penalty | c. | your interest rate

will go up and you will be able to take out your money at any time | b. | you will be able to play your music with a CD, DVD or

BlueRay player | d. | your interest rate will stay the

same but you cannot take your money out without a penalty until the CD has

matured |

|

|

|

19.

|

What are some of the ways that

people use banks to save money? (select all that apply)

|

|

|

Loans

Banks also perform the important service of providing loans. As you have read, the

first banks started doing business when goldsmiths issued paper receipts.

These receipts

represented gold coins that the goldsmith held in safe storage for his customers. He would

charge

a small fee for this service. In early banks, those receipts were fully backed

by

gold —every customer who held a receipt could be sure that the goldsmith kept the

equivalent amount of gold in his safe. Gradually, however, goldsmiths realized that their customers

seldom, if ever, asked for all of their gold on one day. Goldsmiths could thus lend out half or even

three quarters of their gold at any one time and still have enough gold to handle customer demand.

Why did goldsmiths want to lend gold

The answer is that they charged interest on their loans.

By keeping just enough gold reserves to cover demand, goldsmiths could run a profitable business

lending deposits to borrowers and earning interest. The first banks were based on this practice. A

banking system that keeps only a fraction of funds on hand and lends out the remainder is called

fractional reserve banking. Like the early banks, today ’s banks also operate on this

principle. They lend money to homeowners for home improvements,

to families to pay for college

tuition,

|

and to businesses. The more money a bank lends out, and the higher the

interest rate it charges borrowers, the more profit a bank is able to make. By making loans, banks

help new businesses get started, and they help established businesses grow. When a business gets a

loan, that business can create new jobs by

hiring new workers or investing in physical capital in

order to increase production.

A business that gets a loan may also help other businesses

grow. For example, suppose you and a friend want to start a window-washing business. Your business

will need supplies like window cleaner and ladders, so the companies that make your supplies will

also benefit. They may even hire workers to expand their businesses.

Bankers must, however,

consider the security of the loans they make. Suppose borrowers default, or fail to pay back their loans Then

the bank loses money. Bankers therefore always face a trade-off between profits and safety. If they

make too many bad loans —loans that are not repaid —they may go out of

business altogether. (See pages 510 –511 of the Personal Finance Handbook to learn more

about banks and the services they offer.)

| | |

|

|

|

20.

|

Why do banks make

loans?

a. | They don’t like to keep too

much money in their vaults | c. | They make money by charging interest | b. | Banks do not make loans | d. | The government requires them to |

|

|

|

21.

|

What do the banks do with the

money they take in as deposits?

a. | They lend out part of the money as

loans | c. | They turn it over to the U.S.

Treasury Department | b. | They keep it in a safe place and do not use it for any

purpose | d. | They buy gold and keep it in their

vaults |

|

|

|

22.

|

What do they call a banking

system that keeps only a fraction of funds on hand and lends out the remainder?

a. | return to zero

banking | c. | fractional reserve

banking. | b. | the Federal Reserve system | d. | zero reserve banking |

|

|

|

23.

|

What is the trade-off that

bankers must face when they make loans?

a. | interest on the loans vs the danger

that the borrower may default | c. | they may have to make too many loans to handicapped

individuals | b. | a lack of deposits and interest they must pay on

deposits | d. | being looked down upon by the

community |

|

|

|

Mortgages

A mortgage is a specific type of loan that is

used to buy real estate.

Suppose the Lee

family wants to buy a house for $200,000.

They are unlikely to have the cash

on

hand to be able to pay for the house. Like

almost all home-buyers, they will need to

take

out a mortgage.

The Lees can afford to make a down

payment of 20 percent of the price of

the

house, or $40,000. After investigating the

Lees ’s creditworthiness, their bank

agrees

to lend them the remaining $160,000 so

that they can purchase their new

house.

Mortgages usually last for 15, 25, or 30

years. According to the terms of their

loan,

the Lees are responsible for paying

back the loan plus whatever interest the

bank charges over

a period of 25 years.

| Credit

Cards

If you look at a

credit card, somewhere

you will see the name of a bank printed on

it. Another service that

banks provide is

issuing credit cards —cards entitling their

holders to buy

goods and services based

on the cardholder ’s promise to pay for

these goods and

services.

How do credit cards work Suppose you

buy a sleeping bag and tent for $100

on

May 3. You do not actually pay for the

gear until you receive your credit-card bill

and

pay it in June. In the meantime,

however, the credit-card issuer (the bank)

will have paid the

sporting goods store.

Your payment repays the bank for the

“loan ” of

$100.

The person who owns and uses the card pays interest and the companies that accept the

cards pay a fee to the bank issuing the card.

| | |

|

|

|

24.

|

What is a

mortgage?

a. | money the bank owes to

depositors | c. | a bank loan used

for funeral expenses | b. | a down payment on a real estate loan | d. | a loan used to purchase real

estate |

|

|

|

25.

|

You go to the bank to borrow

$20.000 for a new car. The bank gives you the loan. The $20,000 is called the

a. | card

charge | c. | interest | b. | principal | d. | mortgage |

|

|

|

26.

|

The bank charges you for your

auto loan. What are the bank charges called?

a. | principal | c. | depreciation | b. | interest | d. | excise taxes |

|

|

|

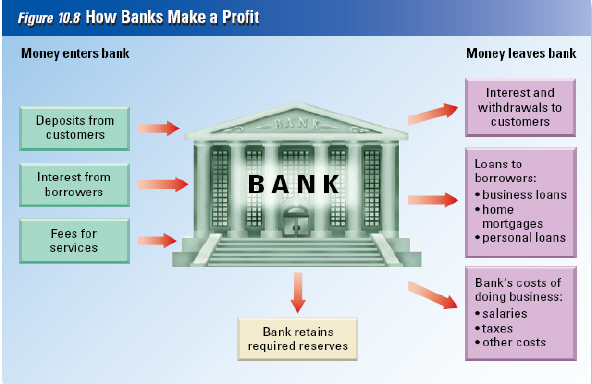

Banks and

Profit

The largest

source of income for banks is the interest they receive from customers who have taken loans. Banks,

of course, also pay out interest on customers’ savings and most checking accounts. The amount

of interest they pay out, however, is less than the amount of interest they charge on loans. The

difference in the amounts is how banks cover their costs and make a

profit. | |

|

|

|

27.

|

What is the largest source of

income for banks?

a. | Insurance from the

FDIC | c. | Interest on the loans they

make. | b. | Deposits from the Federal Reserve Bank | d. | Deposits from consumers |

|

|

|

28.

|

Which statement is

true?

a. | Banks pay out more money in interest

to depositors than they take in from loans they make | c. | Fees are the greatest source of income for

banks | b. | Banks pay interest to the people who deposit money in their bank but the

charge more to people who borrow money from the bank | d. | The Banks costs of doing business is greater than the profits they make by

making loans |

|

|

|

29.

|

Which color boxes represent the

greatest amount of money?

a. | the green boxes (money

entering) | c. | the brown box

(reserves) | b. | the purple boxes (money leaving) | d. | all of the boxes represent equal amounts of money otherwise the bank would not

be able to stay in business |

|

|

|

Types of

Financial Institutions

Several kinds of financial institutions

operate in the United States. These

include

commercial banks, savings and loan associations, mutual savings banks, and credit unions.

During the 1990s, these financial institutions became more similar than dissimilar, although

differences still remain.

Commercial

Banks

Commercial banks, which traditionally

provided services to businesses, offer

a

wide range of services today. Commercial

banks offer checking services, accept

deposits,

and make loans. Some commercial

banks are chartered by states and are

regulated by state

authorities and by the

Federal Deposit Insurance Corporation

(FDIC). About one third of all

commercial

banks are national banks and are part of

the Federal Reserve System.

Commercial

banks provide the most services and play

the largest role in the economy of any

type

of bank.

Savings and Loan

Associations

Savings and Loan Associations (S&Ls),

which you read about in

Section 2, were

originally chartered to lend money for

building homes during the mid-1800s.

Members of Savings and Loan Associations

deposited funds into a large general fund and then

borrowed enough money to buy their own houses. Savings and Loans are also called thrifts

because they originally enabled “thrifty ” working class

people —that is, people who were careful with their money —to save up and

borrow enough to buy their own homes. Over time, Savings and Loan Associations have taken on many of

the same functions as commercial banks. | Savings

Banks

Mutual savings

banks (MSBs) originated

in the early 1800s to serve people who

made smaller deposits and

transactions

than commercial banks wished to handle.

Mutual savings banks were owned by

the

depositors themselves, who shared in any

profits. Later, many MSBs began to sell

stock

to raise additional capital. These

institutions became simply savings banks

because depositors

no longer owned them.

Although savings banks were traditionally

concentrated in the

Northeast, they

had an important influence on the national

economy. In 1972, the Consumer

’s Savings

Bank of Worcester, Massachusetts, introduced a Negotiable Order of

Withdrawal

(NOW) account, a type of checking

account that pays interest. NOW accounts

became

available nationwide in 1980.

Credit

Unions

Credit unions are cooperative lending

associations for particular groups,

usually

employees of a specific firm or government

agency. Credit unions are commonly

fairly

small and specialize in home mortgages

and car loans, usually at interest

rates

favorable to members. Some credit unions

also provide checking account

services.

Finance Companies

Finance companies

make installment loans

to consumers. These loans spread the cost

of major purchases like

computers, cars,

refrigerators, and recreational vehicles

over a number of months. Because

people

who borrow from finance companies more

frequently fail to repay the loans,

finance

companies generally charge higher interest

rates than banks

do. | | |

|

|

|

30.

|

How are Commercial banks

different from Savings and Loan Associations?

a. | Savings and Loans offer more

services | c. | Savings and Loans

can only operate in the cities | b. | Commercial banks offer more services | d. | Commercial banks make real estate

loans |

|

|

|

31.

|

Which institution charges the

highest interest rate on loans to consumers?

a. | savings and loans

| c. | credit

unions | b. | finance companies | d. | commercial banks |

|

|

|

32.

|

What were NOW accounts offered

by Savings Banks?

a. | Banks that go out of their way to

help women | c. | accounts that

offered interest on checking accounts | b. | interest free loans | d. | banks that cater to the National Organization of

Women |

|

|

|

33.

|

What does the North Island

Federal, Navy Credit, and Mission Federal have in common

a. | they are all credit unions that

cater to special groups of people | c. | they are commercial banks | b. | they are all savings

banks | d. | they have nothing in

common |

|

|

|

Electronic

Banking

Banks began

to use computers in the early

1970s to keep track of transactions. As

computers have become

more common in

the United States, their role in banking has

also increased dramatically. In

fact,

computerized banking may revolutionize banking in much the same way that paper

currency

changed banking long ago.

Automated Teller

Machines

If you use an Automated Teller Machine

(ATM), you are already familiar with

one

of the most common types of electronic

banking. ATMs are computers that customers can use

to deposit money, withdraw cash, and obtain account information at their convenience. Instead of

having to go to the bank during the bank ’s hours of operation to conduct banking

business face –to –face with a teller, you can take care of your finances at

an ATM.

ATMs are convenient for both banks and for customers, since they are available 24

hours a day and reduce banks ’ labor costs. The overwhelming popularity of ATMs suggests

that they are likely to be a permanent feature of modern banking.

|

Debit Cards

Debit cards are used to withdraw money.

You may use a debit card to

withdraw

money at an ATM. You may also use a debit card in stores equipped with special machines.

When you “swipe ” your card through one of these machines, your

debit

card sends a message to your bank to transfer money from your checking account directly into

the store ’s bank account. For security, debit cards require customers to use personal

identification numbers, or PINs, to authorize financial transactions.

| | |

|

|

|

34.

|

What one thing is

necessary for the function and operation of Electronic Banking?

a. | people to take deposits and disperse

money (tellers) | c. | FDIC

insurance | b. | commercial banking | d. | computers |

|

|

|

Home

Banking

More and more

people are using the

Internet to conduct their financial

business. Many banks, credit unions,

and

other financial institutions allow people to

check account balances, transfer money

to

different accounts, pay their bills, and

automatically deposit their paychecks

via

computer.

Automatic Clearing

Houses

Automatic Clearing Houses (ACHs),

located at Federal Reserve Banks and

their

branches, allow customers to pay bills

without writing checks. An ACH transfers

funds

automatically from customers ’

accounts to creditors ’ accounts. (A

creditor

is a person or institution to whom money

is owed.) People usually use ACHs to

pay

regular monthly bills like mortgage

payments, rent, utility bills, and

insurance

premiums. They save time, postage costs,

and any worries about forgetting to

make

a payment.

| Stored Value

Cards

Stored value

cards, or smart cards, are

similar to debit cards. These cards are

embedded with either

magnetic strips or

computer chips with account balance

information. Smart cards include

cards

issued to college students living in dormitories

to pay for cafeteria food,

computer

time, or photocopying. Phone cards, with

which customers prepay for a

specified

amount of long-distance calling, are also

smart cards.

Will stored value smart

cards someday

replace cash altogether No one can know

for sure, but private companies and

public

facilities have continued to explore new

uses for smart card

technology. | | |

|

|

|

35.

|

Your grandfather gives you a

prepaid Visa card for $200. This is an example of

a. | automatic Clearing House

card | c. | stored value

card | b. | Home Banking | d. | a consumer loan |

|

|

|

36.

|

You need to know how much money

you have in your bank account. You go to the computer and check your balance. This is an example

of

a. | Home

Banking | c. | Stored Value

Accounting | b. | Automatic Clearing House | d. | Traditional Banking |

|

|

|

a. | liquidity | g. | fractional reserve banking | b. | credit card | h. | principal | c. | money supply | i. | interest | d. | debit card | j. | demand deposit | e. | mortgage | k. | creditor | f. | default | l. | money market mutual fund |

|

|

|

37.

|

a specific type of loan that is used to buy real

estate

|

|

|

38.

|

a banking system that keeps

only a fraction of funds on hand and lends out the remainder

|

|

|

39.

|

a card used to withdraw money

|

|

|

40.

|

all the money available in the United States

economy

|

|

|

41.

|

failure to pay back a loan

|

|

|

42.

|

the price paid for the use of borrowed

money

|

|

|

43.

|

the ability to be used as, or directly converted to,

cash

|

|

|

44.

|

person or institution to whom money is

owed

|

|

|

45.

|

a fund that pools money from small savers to purchase

short-term government and corporate securities

|

|

|

46.

|

a card entitling its holder to buy goods and services

based on the holder’s promise to pay for

these goods and services

|

|

|

47.

|

the money in checking

accounts

|

|

|

48.

|

the amount of money borrowed

|