|

|

|

Objectives

After studying this section you will be able to:

1. Describe the three uses

of money.

2. Explain the six characteristics of money.

3. Understand the sources

of money ’s value. | Section

Focus

Money serves as a

medium of

exchange, a unit of account,

and a store of value. Although

many objects have

served as

money in the past, the coins

and bills we use today meet

the needs of modern

society | Key Terms

money

medium of exchange

barter

unit of

account

store of value

currency

commodity

money

representative money

fiat

money | | | |

|

|

|

1.

|

Study the introduction to Ch 10

Section 1. Explain what you are expected to learn from this unit. Also, try to remember the

vocabulary words as you encounter them in the lessons that follow. You will be tested on these words

later

|

|

|

Suppose you have just arrived at your

neighborhood store after playing

basketball

on a hot day. You grab a soda

and fish around in your jeans pockets for

some money. You find a

pen, keys, and a

chewing gum wrapper, but, unfortunately,

no money. Then you reach into your

jacket

pocket. Finally! —a crumpled dollar bill.

You hand the money to the clerk

and take a

long, cold drink.

Money is a part of our daily lives.

Without it, we

can ’t get the things we need

and want. That ’s not the whole story

of

money, however. In fact, money has functions and characteristics that you might

never have

thought about.

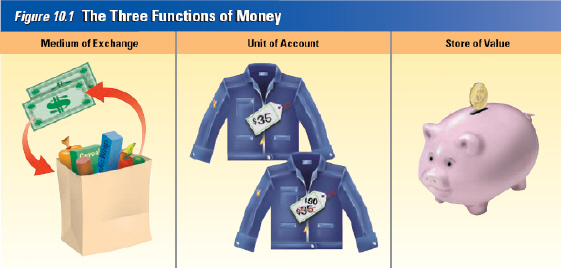

| The Three Uses of

Money

If you were

asked to define money, you

would probably think of the coins and bills

in your wallet or the

paychecks you receive

for your part-time job. Economists define

money in terms of its three

uses. For an

economist, money is anything that serves as

a medium of exchange, a unit of

account,

and a store of value.

| | |

|

|

|

2.

|

Which statement below is most

correct about the way Economists see money?

a. | Money has a singular

purpose | c. | Money has at least

three purposes | b. | Money is the only thing people can use to exchange goods and

services | d. | Money is always in the form of bills

and coins |

|

|

|

Money as a

Medium of Exchange

A

medium of exchange is anything that is

used to determine value during the

exchange of

goods and services. Without

money, people acquire goods and services

through barter, or

the direct exchange of

one set of goods or services for another.

Barter is still used in many

parts of the

world, especially in traditional economies

in Asia, Africa, and Latin America. It

is

also sometimes used informally in the

United States. For example, a person might

agree to

help paint a neighbor’s house in

exchange for vegetables from the

neighbor’s

garden. In general, however, as an

economy becomes more

specialized,

bartering becomes too difficult and time consuming to be practical.

To

appreciate how much easier money

makes exchanges, suppose that money did

not exist, and that

you wanted to trade

your video cassette recorder (VCR) for an

audio CD player. You probably

would have

a great deal of trouble making the

exchange. First, you would need to

find

someone who wanted to both sell the

|

model of CD player you want and

buy

your particular VCR. Second, this person

would need to agree that your VCR is

worth the

same as his or her CD player. As

you might guess, people in barter

economies spend a great deal

of time and

effort exchanging the goods they have for

the goods they need and want.

That’s why

barter generally works well only in small,

traditional economies.

Now

consider how much easier your

transaction would be if you used money as

a medium of exchange.

All you would have

to do is find someone who is willing to pay

you $100 for your VCR. Then you

could

use that money to buy a CD player from

someone else. The person selling you the

CD

player can use the $100 however he or

she wishes. By the same token, the person

who buys your

VCR can raise that money

however he or she wishes. Because money

makes exchanges so much

easier, people

have been using it for thousands of

years.

| | |

|

|

|

3.

|

Farmer Lopez has a horse that

needs new shoes. He goes to blacksmith Schneemann and gives him a pig to do the job. This is an

example of

a. | service for service

exchange | c. | money as a store

of value | b. | bartering | d. | goods for goods exchange |

|

|

|

4.

|

What is the main idea of the

reading above?

a. | Money makes the economy run

smoothly | c. | Money is the root

of all evil | b. | Money and barter are two different things | d. | Money can destroy an economy |

|

|

|

Money as a

Unit of Account

In

addition to serving as a medium of

exchange, money serves as a unit of

account. In other

words, money provides a means for comparing the values of goods and services. For example, suppose

you see a jacket on sale for $30. You know this is a good price because you have checked the price of

the same or similar jackets in other stores. You can compare the cost of the jacket in this store

with the cost in other stores because the price is expressed

in the same way in every store in

the

United States? —in terms of dollars and

cents. Similarly, you would expect a movie in

the theater to cost about $7.00, a video rental about $3.50, and so forth.

. | Other countries

have their own forms of

money that serve as units of account. The Japanese quote prices in terms

of yen, the Russians in terms of rubles, Mexicans in terms of nuevo pesos, and so

forth | | |

|

|

|

5.

|

A Unit of Account allows people

to

a. | purchase products at lower

prices | c. | exchange

products | b. | compare products | d. | increase their wealth |

|

|

|

6.

|

In the United States we express

a Unit of Account in terms of

a. | the quality of the products we

buy | c. | international

currency | b. | dollars and cents | d. | the health and safety of

products |

|

|

|

Money as a

Store of Value

Money

also serves as a store of value. This means that money keeps its value if you decide to hold

on to —or store —it instead of spending it. For example, when you sell your

VCR to purchase a CD player, you might not have a chance to purchase a CD player right away. In the

meantime, you can keep the money in your wallet or in a bank. The money will still be valuable and

will be recognized as a medium of exchange weeks or months from now when you go to buy the CD

player.

Money serves as a good store of value

with one important exception.

Sometimes

economies experience a period of rapid

inflation, or a general increase in

prices.

For example, suppose the United States

experiences 10 percent inflation during

a

particular year. If you sold your VCR at

|

the beginning of that year for $100,

the

money you received would have 10

percent less value, or buying power, at the end of the

year. This is because the price

of the CD player would have increased by

10 percent during the

year, to $110. The

$100 you received at the beginning of the

year would no longer be enough to

buy the

CD player.

In short, when an economy experiences

inflation, money does not

function as well

as a store of value. You will read more

about the causes and effects of

inflation in

Chapter 13 | | |

|

|

|

7.

|

Farmer Frank has 100 pigs.

Those pigs have value. How would farmer Frank convert the value of the pigs into something he can put

in his pocket?

a. | Convert the 100 pigs into money by

selling them | c. | Write the value of

the pigs on a piece of paper and put the paper in his pocket | b. | Trade the 100 pigs to another farmer for some other

product such as cows | d. | There is no way to convert the value

of a pig into something you can put in your pocket |

|

|

|

8.

|

If you have $100. it means that

you can purchase $100 worth of goods and services. When the price of goods and services rises, it is

called inflation. What happens to your $100 during inflation?

a. | Its value rises with inflation

because things now cost more | c. | Its value declines with inflation because you can buy less goods and services

with your $100 | b. | Its value stays the same because money is not goods and

services | d. | Its value rises with inflation

because things now cost less |

|

|

|

9.

|

During a period of

inflation

a. | money functions the same as a store

of value | c. | money functions

better as a store of value | b. | money stays the same because prices stay the

same | d. | money functions less well as a store of

value |

|

|

|

The Six

Characteristics

of Money

The coins and paper bills used as money

are called currency. In the past,

societies

have also used an astoundingly wide range

of other objects as currency. Cattle,

salt,

dried fish, furs, precious stones, gold, and

silver have all served as currency

at

various times in various places. So have

porpoise teeth, rice, wheat, shells,

tulip

bulbs, and olive oil. These items all

worked well in the societies in which they

were

used. None of them, however, would

function very well in our economy today.

Each lacks at least

one of the six characteristics that economists use to judge how well an item serves as currency.

These six characteristics are durability, portability,

divisibility, uniformity, limited supply,

and

acceptability. |

1 Durability

Objects used as money must withstand

the

physical wear and tear that comes with

being used over and over again. If money

wears

out or is easily destroyed, it cannot

be trusted to serve as a store of value.

Unlike wheat or

olive oil, coins last for

many years. In fact, some collectors have

ancient Roman coins that

are more than

2,000 years old. While our paper money

may not seem very durable, its rag

(cloth)

content helps $1 bills typically last at least

a year in circulation. When paper bills

wear

out, the United States government can

easily replace them. | | |

|

|

|

10.

|

What is

currency?

a. | gold and

silver | c. | the many objects that past societies

have used to trade | b. | coins and bills we can hold in our pockets | d. | all of these choices are forms of

currency |

|

|

|

11.

|

Which item below passes the

durability test for money?

a. | coins and vegetable

products | c. | news print paper

and coins | b. | coins and paper with cloth content | d. | money and power |

|

|

|

12.

|

Which of the following items is

NOT a characteristic that

economists use to judge how well an item serves as currency.

a. | portability | e. | sensibility | b. | divisibility | f. | acceptability | c. | durability | g. | uniformity | d. | limited supply |

|

|

|

2

Portability

People

need to be able to take money with

them as they go about their daily business.

They also must

be able to easily transfer

money from one person to another when

they use money for purchases.

Paper money

and coins are very portable, or easily

carried, because they are small and

light.

3 Divisibility

To be useful, money

must be easily divided

into smaller denominations, or units of

value. When money is divisible,

people

only have to use as much of it as necessary

for any exchange. In the 16th and 17th

centuries, people actually used pieces of coins to pay exact amounts for their purchases.

Spanish

coins called doubloons had lines scored or etched on them so that they could be easily divided into

eight parts. Spanish coins, in fact, came to be called ? “pieces of eight.? ” Today, of

course, if you use a $20 bill to pay for a $5 lunch, the cashier will not rip your bill into four

pieces in order to make

change. That? ’s because American currency, like currencies around

the world, consists of various denominations? —$5 bills, $10 bills, and so

on. | 4

Uniformity

Any two

units of money must be

uniform? —that is, the same? —in terms of

what they will

buy. In other words, people

must be able to count and measure money

accurately.

Suppose

everything were priced in terms

of dried fish. One small dried fish might

buy an apple. One

large dried fish might

buy a sandwich. This method of pricing is

not a very accurate way of

establishing the

standard value of products because the size

of a dried fish can vary. Picture

the arguments people would have when trying to agree whether a fish was small or large. A dollar

bill, however, always buys $1 worth of goods. | | |

|

|

|

13.

|

The fact that you can carry

your money in your pocket when you go on vacation shows that money is

a. | uniform | c. | portable | b. | divisible | d. | sensible |

|

|

|

14.

|

Which statement is

true?

a. | Spanish money was devisable while

American money is not | c. | Neither Spanish

nor American money is or has been devisable | b. | Spanish money was devisable and so is American

money | d. | All money has the same

value |

|

|

|

15.

|

Which statement is

true?

a. | Individual units of money should

have the same value | c. | Individual units

of money from each country has the same value | b. | Individual units of money cannot have the same

value | d. | money has no

value |

|

|

|

5 Limited

Supply

Suppose a

society uses certain pebbles as

money. These pebbles have only been

found on one beach. One

day, however,

someone finds an enormous supply of

similar pebbles on a different beach.

Now

anyone can scoop up these pebbles by the

handful. Since these pebbles are no longer in

limited supply, they are no longer useful

as currency.

In the United States, the Federal

Reserve

System controls the supply of money in

circulation. By its actions, the

Federal

Reserve is able to keep just the right

amount of money available. You’ll

read

more about how the Federal Reserve

monitors and adjusts the money supply in

Chapter

16. | 6

Acceptability

Finally, everyone in an economy must be

able to exchange the objects that serve

as

money for goods and services. When you

go to the store, why does the person behind

the

counter accept your money in exchange

for a carton of milk or a box of pencils?

After all,

money is just pieces of metal or

paper. Your money is accepted because the

owner of the store

can spend it elsewhere to

buy something he or she needs or wants.

In the United States, we

expect that other

people in the country will continue to

accept paper money and coins in

exchange

for our purchases. If people suddenly lost

confidence in our currency’s value,

they

would no longer be willing to sell goods

and services in return for dollars.

| | |

|

|

|

16.

|

The Acceptability of money

means

a. | it must be attractive and long

lasting | c. | people are not

willing to exchange if for goods and services | b. | money must be different from other goods and

services | d. | people are willing to exchange if

for goods and services |

|

|

|

17.

|

Your grandfather decides to

exchange all of his retirement money for gold. What would happen if someone discovered an unlimited

supply of gold in Alaska?

a. | Grandp’s retirement savings

would most likely be worthless | c. | Grandp’s retirement savings would decrease

slightly | b. | Grandp’s retirement savings would increase in

value | d. | Grandp’s retirement savings would not be

effected |

|

|

|

18.

|

Which government agency

controls the supply of money in circulation?

a. | The Federal Trade

Commission | c. | The Internal

Revenue Service | b. | The Federal Communication Commission | d. | The Federal Reserve Bank |

|

|

|

19.

|

You have $1,000 in savings.

What would happen to your $1,000 if the Federal Reserve Bank decided to increase the supply of money

in circulation?

a. | Your $1,000 would be worth less

| c. | Your $1,000 would be worth

more | b. | Your $1,000 would be worth about the same | d. | The value of money is not effected by the behavior of the Federal Reserve

Bank |

|

|

|

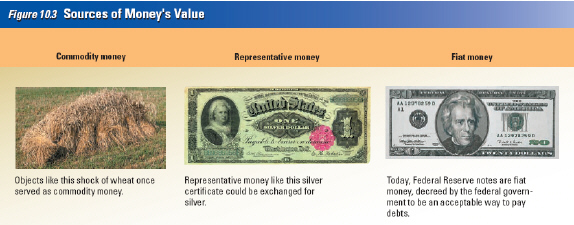

Sources of

Money’s Value

Think about the bills and coins in your

pocket. They are durable and

portable.

They are also easily divisible, uniform, in

limited supply, and accepted

throughout

the country. As convenient and practical as

they may be, however, bills and coins

have

very little value in and of themselves. What,

then, makes money valuable? The answer

is

that there are actually several possible

sources of money’s value, depending on

whether

the money is commodity, representative, or fiat money.

Commodity Money

A commodity is an object. Commodity money

consists of objects that have value in and of themselves and that are also used as

money.

|

For example, salt, cattle, and precious

stones have been used in

various societies

as commodity money. These objects have

other uses as well. If not used as

money,

salt can preserve food and make it tastier.

Cattle can be slaughtered for their

meat,

and gems can be made into jewelry.

Tobacco, corn, and cotton all served as

commodity

money in the American

colonies.

As you can guess, commodity money

tends to lack several

of the characteristics

that make objects good sources of money.

For example, it is often not

portable,

durable, or divisible. That’s why

commodity money only works in

simple

economies. As the American colonies developed more complex economic systems,

tobacco and

other objects were no longer

universally accepted as money. The colonies

needed a more

convenient payment system.

They turned to representative money to

meet their

needs. | | |

|

|

|

20.

|

Oil is an example of

a. | representative

money | c. | commodity | b. | fiat money |

|

|

|

21.

|

Gold and silver certificates

are an examples of

a. | representative

money | c. | fiat

money | b. | commodity money |

|

|

|

22.

|

Federal Reserve Notes are an

example of

a. | fiat

money | c. | commodity

money | b. | representative money |

|

|

|

23.

|

Which type of money serves the

needs of the United States best?

a. | commodity

money | c. | representative

money | b. | fiat money | d. | no one form of money serves the needs of the United States

best |

|

|

|

Representative Money

Representative money makes use of

objects

that have value because the holder can

exchange them for something else of

value.

For example, if your brother gives you an

IOU, the piece of paper itself is

worth

nothing. The promise that he will do all of

your chores for a month may be worth

quite

a lot, however. The piece of paper

simply represents his promise to you.

Early

representative money took the

form of paper receipts for gold and silver.

Gold or silver money

was heavy and thus

inconvenient for customers and merchants

to carry around. Each time someone

made

a transaction, the coins would have to be

weighed and tested for purity. People therefore

started to leave their gold in goldsmiths’ safes. Customers would carry paper ownership

receipts from the goldsmith to show how much gold they owned. After a while merchants began to accept

goldsmiths ’ receipts instead of the gold itself. In this way, the paper receipts became

an early form of paper money.

Colonists in the Massachusetts Bay

Colony first used

representative money in

the late 1600s when the Colony ’s treasurer

issued bills of

credit to lenders to help

finance King William ’s War. The bills of

credit showed

the exact amount that

colonists had loaned to the Massachusetts

government. Bill holders could

redeem the paper for specie, that is, gold and silver coins. |

Representative money was not without

its problems. During the American Revolution,

the Second Continental Congress

issued

representative money called Continentals to finance the war against England. Unfortunately,

few people were able to redeem these early paper currencies for specie because the federal

government

had no power to collect taxes. Until

the Constitution replaced the Articles

of

Confederation in 1789, the federal government depended on the states ’ voluntary

contributions to fill the treasury. As a result, the federal treasury held very little

gold or

silver. Continentals became worthless

because people came to believe that they would not be able

to redeem their bills for gold and silver coins. People even began to use the phrase

“not worth a Continental ” to refer to something useless.

Later, the United

States government issued representative money in the form of silver and gold certificates. These

certificates were “backed ” by gold or silver. In other

words,

holders of such certificates could

redeem them for gold or silver at a local

bank. The United

States government thus

had to keep vast supplies of gold and silver

on hand to be able to

convert all paper

dollars to gold if the demand arose. Some

silver certificates circulated

until 1971, but

for the most part, the government stopped

converting paper money into silver or

gold

in the 1930s. | | |

|

|

|

24.

|

What does the above reading

suggest about the value of representative money?

a. | Representative money has always been

a stable source of value | c. | Representative money has no value apart from the gold and silver that it

represents | b. | When the government raises taxes it increases the value of Representative

Money backed by gold and silver | d. | Representative money gets its value from the confidence people have that they

will be able to redeem their money for goods and

services |

|

|

|

25.

|

During the Civil War the

Confederate States issued representative money called “Confederate Dollars.” What does

the reading above suggest about the value of Confederate Dollars?

a. | It is highly

valuable | c. | It had the same

value as Union dollars | b. | It is worthless | d. | It could only be used inside the Confederate States to purchase goods and

services. |

|

|

|

Fiat

Money

If you examine

a dollar bill, you will see

George Washington’s picture on one side,

and on the other

side the words, “This note

is legal tender for all debts, public and private. ” In

essence, these words mean that

our money is valuable because our government says it is.

| United States money today is fiat money.

A fiat is an order or decree.

Fiat money, also

called

“legal tender,” has value because the government has decreed that it is an acceptable

means to pay debts. It remains in

limited supply, and therefore valuable,

because the Federal

Reserve controls its

supply. This control of the money supply is

essential for a fiat system to

work. | | |

|

|

|

26.

|

What does the reading say about

“Fiat Money” ?

a. | Fiat money has value because the

government says it has value | c. | Fiat money is worthless | b. | Fiat money has value because it is backed by gold or

silver | d. | The value of Fiat Money is always the

same. |

|

|

|

a. | currency | f. | service money | b. | medium of exchange | g. | unit of account | c. | fiat money | h. | barter | d. | store of value | i. | money | e. | commodity money | j. | representative money |

|

|

|

27.

|

the direct exchange of one

set of goods or services for another

|

|

|

28.

|

a means for comparing the

values of goods and services

|

|

|

29.

|

objects that have value

because the holder can exchange them for something else of value

|

|

|

30.

|

coins and paper bills used as

money

|

|

|

31.

|

something that keeps its value

if it is stored rather than used

|

|

|

32.

|

money that has value because

the government has ordered that it is an acceptable means to pay debts

|

|

|

33.

|

objects that have value in

themselves and that are also used as money

|

|

|

34.

|

anything that serves as a

medium of exchange, a unit of account, and a store of value

|

|

|

35.

|

anything that is used to

determine value during the exchange of goods and services

|